r&d tax credit calculator hmrc

It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company. RD Tax Calculator Find out how.

CT due of 615600 prior to use of RDEC.

. Tax credits calculator - GOVUK. Most RD tax credit calculations or worked examples that youll see online start by establishing which schemes apply. Before you can claim RD Tax Credits an excellent and lucrative source of government funding you need to work out.

Calculate RD tax relief in under 3 minutes. Ad RD Tax Credit Claims Developed For Clients Short-Term Long-Term Success. Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process.

The answer is more complicated than youd think. Request form for PAYE CHAPS transfer. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount.

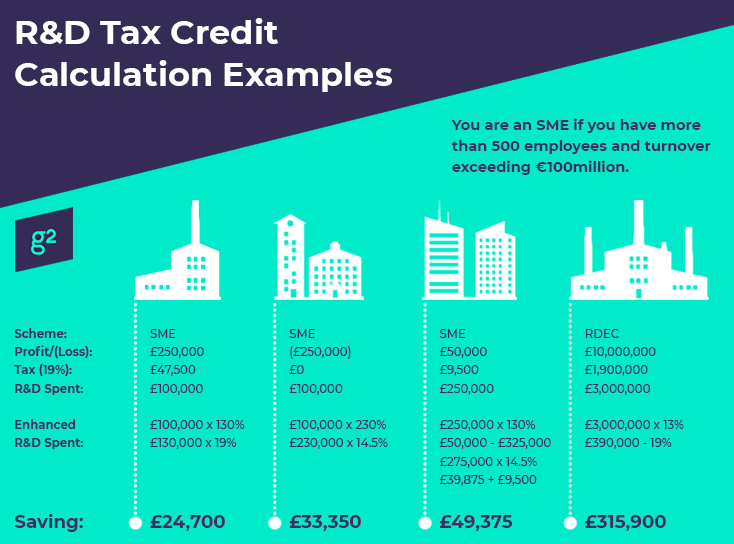

The Research and Development Expenditure Credit rate changed. This can be done for the current financial year and the 2 previous. 25000 x 130 enhancement rate.

Our RD Tax Credit Calculator is a quick and useful tool for estimating the potential value of your RD tax credit claim and all you have to do is answer some simple questions. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim. For Technology Ecommerce Bio-Tech Industries More.

If You Dont Qualify You Dont Pay. You should be eligible for RD tax credits. If you spend money creating or improving products or services.

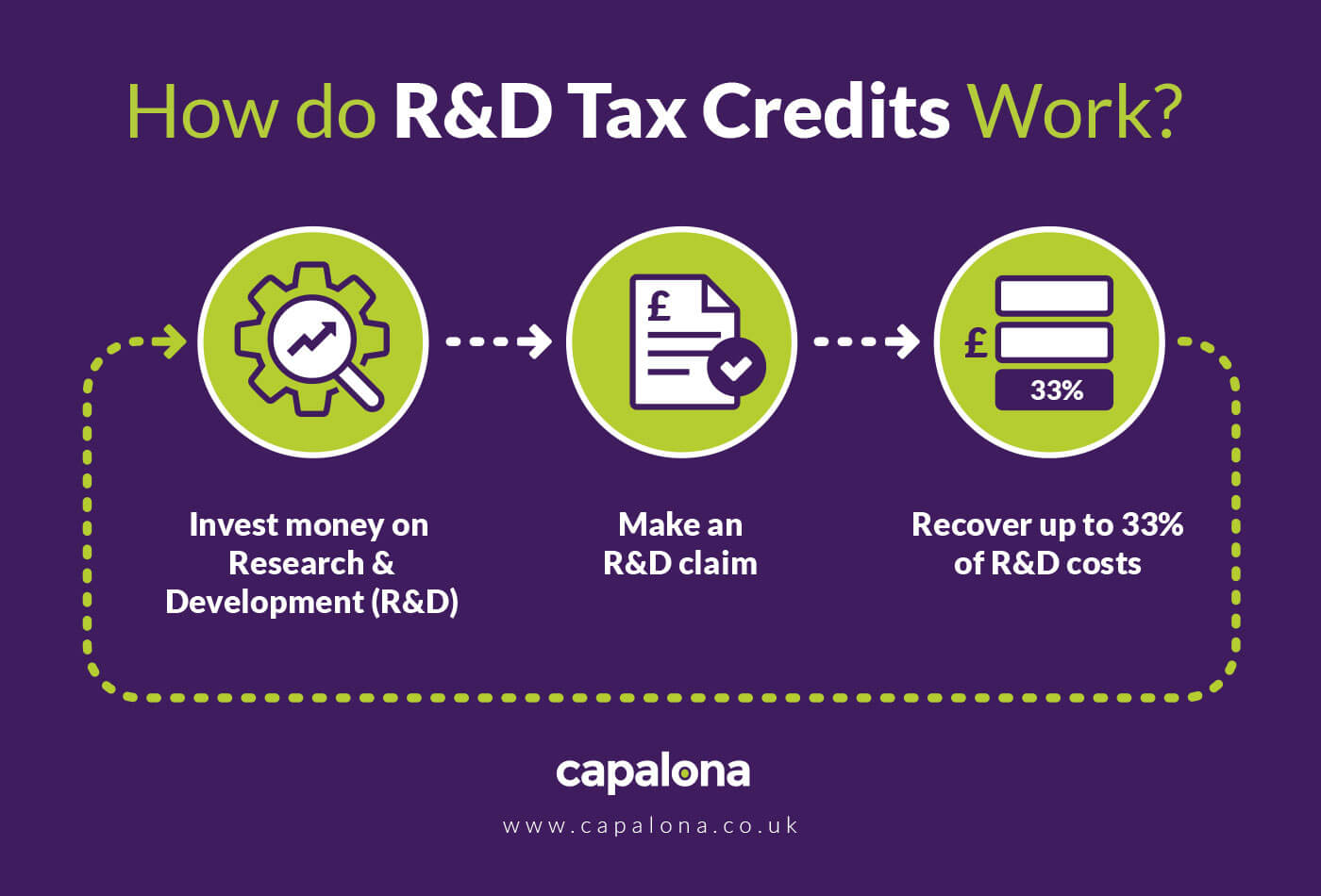

The email address in the When you cannot use the online service section has been updated. Estimated restricted cash benefit. The RD Tax Credits scheme is an HMRC incentive designed to inspire innovation and increased spending on RD activities by companies operating in the UK.

On this page you can calculate the value of your Research Development tax credits claim. Home RD Tax Credits Calculator. Sometimes this is a simple matter of working out whether.

Home RD Tax Credits How Much Can I Claim. The next step is to revise the profit by deducting the RD uplift from profit bringing the revised profit to 120000 250000 130000. The corporation tax at 19 on 250000.

Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. You should be eligible. 100000 x 130 130000 uplift 400000 130000 270000 revised profit 270 000 x 19 51300.

Ad Pilot Takes Care Of The Entire RD Claim Process. For Technology Ecommerce Bio-Tech Industries More. Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process.

SMEs can claim up to 33p for every 1 spent on qualifying RD activities. Ad Pilot Takes Care Of The Entire RD Claim Process. At MPA we have extensive experience in ensuring your claim is accurate and that your value is maximised.

The RDEC is a tax credit it was 11 of your. Tax losses including RD relief. Save Up To 250000 For Your Business.

Calculate the company car tax charge based on a cars. Corporation Tax before RD tax credit claim. Learn If Your Company Qualifies For Research Experimentation RD Tax Credit Today.

How much is my RD tax credit claim worth. Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal. Step 1 the credit discharges any corporation tax liability for the claimant in the accounting period.

Small or medium-sized enterprise SME RD tax relief allows companies to. Get Your RD Credit Estimate. Ad See If Youre Eligible To Claim A RD Tax Credit.

Get Your RD Credit Estimate. Ad See If Youre Eligible To Claim A RD Tax Credit. Show how this example is calculated.

If you add back the qualifying costs of 125000 the company would have a profit of 75000. To put it another way 75000 of the expenditure has already attracted relief and. If You Dont Qualify You Dont Pay.

RD Tax Credits Calculator. Tools to help you run your payroll. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

To reward businesses for their investment the government allows you to enhance your qualifying expenditure. Save Up To 250000 For Your Business. How to calculate the RD tax credit using the traditional method.

RD tax losses 230 of RD spend 115000. It is based upon your RD costs. By answering a series of simple questions our RD tax credit calculator allows you to estimate your potential claim value whether youre due a tax reduction or a cash credit.

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Project Closure Report Template Ppt 7 Templates Example Templates Example Report Template Powerpoint Presentation Professional Templates

R D Tax Credit Calculation Examples Mpa

Hmrc R D Report Template 1 Professional Templates Report Template Templates Professional Templates

Can Pension Contributions Be Included In An R D Tax Credit Claim

Word Document Report Templates 1 Templates Example Templates Example Report Template Acceptance Testing Word Template

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Hmrc Enquiry Defence For R D Claims

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credit Calculation Examples Mpa

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculator Who Is Eligible For Tax Credits Available Grants

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Does Your Business Qualify For R D Tax Credits